I was just replying to a comment this morning and something struck my mind. Recently I had been flamed. Well, I always tell my friends that it is all talks and comments, how would it hurt me when it doesn't hurt my pocket? Furthermore, I don't gossip about others nor do things that hurt anyone, so why flame? Do I owe them something? Did I flame at them? Why are they constantly visiting my blog many times per day when they loathe me so much? Of course I know what they are thinking in their mind and I won't fall for their tricks. Anonymous, like I say, you can keep flaming at me, no problem, because I am simply loving all the limelight and attention you had given me. I believe in karma, what comes around goes around.

All I want to say is this, if ya'll believe what you read in the comments section about me taking 1 pip profit or my course is expensive because it's 5 figures etc then there is no difference between reading a newspaper or magazines and absorb what was anyhow written inside. The public always lose out in the stock market because they believe the media story on prominent newspaper/magazines. Of course some are real and some are fakes but we never know the real intention behind. How can we judge someone when we don't know the person in life? In AGM meeting, the CEO can paint a beautiful story but how come the stock price keep plunging? Do you blame the CEO after that? Do you know what's his real intention? To tell ya'll the truth, I seldom read newspaper and I am not very knowledgeable. I always depend on friends if I want to know some news or reports. Articles published on newspapers/magazines are mostly rumors and tabloids because that interests the public and most are willing to pay money to buy and read it or else how can the media houses survive without the public supporting them? Think about it.

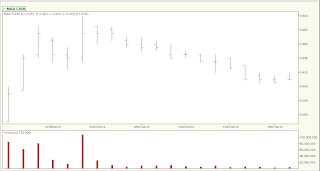

Take all comments and talks with a pinch of salt. If you believe what was said, then well I got nothing to say. If you think I am a bad person, so be it. I cannot pleased everyone, as long as I don't hurt or cause anyone to lose money, then my conscience is clear. Even god himself get criticized, so who am I compared to him? My preview should be coming soon, so if you believe what was written in the previous comments section, please don't come, I don't need your money for my course and you can spend it elsewhere. If you believe in what was written about 5 digits, please don't ever attend my preview session because that was what Anonymous wrote, NOT what was decided by my partner. If you believe in me taking 1 pip, go back and see all my past profits/losses and decide for yourself. Not many people post trade records in blog or elsewhere and I am one of them who do post because I believe in honesty and what you see is what you get. Ask other bloggers or educators to show you their trade records and you will encounter lots of excuses. CityIndex had all my trade history and they know I am for real when it comes to trading big lots. I don't falsify information because I believe in transparency to let others know what am I made of. Do you think CityIndex will work with me if I trade using demo accounts? Think about it.

So to my allegiance fellows fans, my point is very simple, do not believe in assumptions or conclusions based on what you see or read, they may be superficial and floating on the surface. Always do your own due diligence, homework and deep dive investigative work before making that final statement.

Update 7.30AM, July 14, 2012

To add on my point, see the circled headlines. CEO can be accused of frauds and libor can be manipulated by banks' CEO too. Ain't these news juicy enough to suck the public to read? Are we reading the real story that was published? Do we know their intention? Do we know the CEO in person? Do I go flame and comment on the CEOs' actions? Based on my character, I don't bother because whatever it is, it is just a news published so as to gain traffic and readership. I don't know those CEOs personally and they did not hurt my pocket in any fashion. I believe in karma, what you sow is what you reap. As long as I mind my own business and do good then all outward things will take care of itself. I am a magnanimous person, so I won't hold against all the tawpie who don't know me personally and flame me. :)

Ronald K - Market Psychologist - The Big Speculator